80% Lump Sum Revolution: How to Retire with More Money in 2026

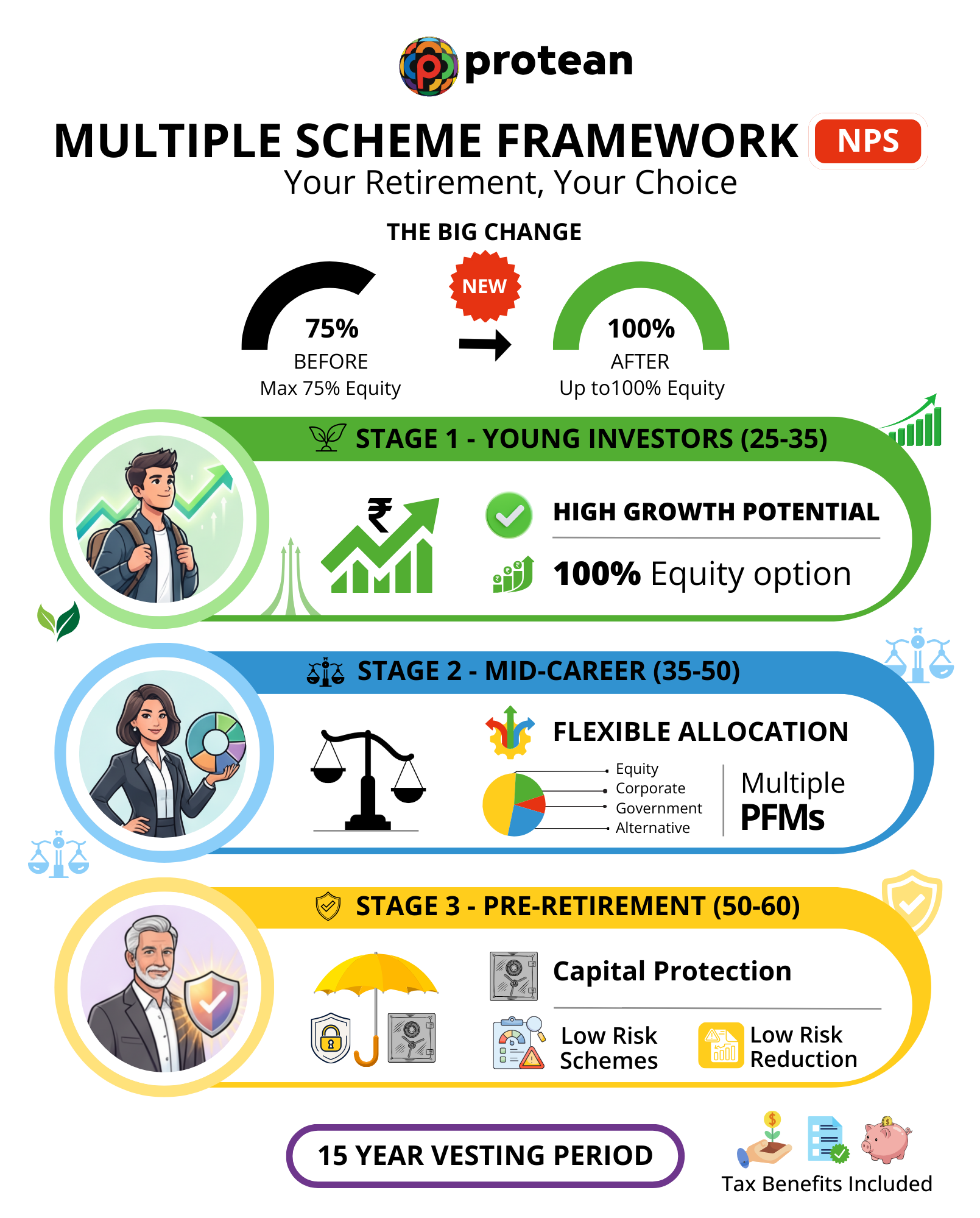

Multiple Scheme Framework: NPS for Every Life Stage

Know how e Stamp works as a Shield for Legal Documents

Have you ever worried that the legal document you just signed might be easily tampered with?

For decades, traditional stamp papers have been the standard way to pay stamp duty for agreements, property deals, and affidavits. But they had a serious downside: they were vulnerable to forgery, duplication, and even backdating. Tampered or forged stamp papers can lead to serious legal disputes and financial loss if a document’s authenticity is later challenged.

10 Document Workflows You Must Digitize with Virtual/Digital Signature

As the clock ticks down toward the end of the financial year, the office atmosphere often shifts from steady to increasingly hectic. Desks fill up with paper, printers run constantly, and managers race to collect physical signatures on urgent contracts.

Does this sound familiar? If you’re still relying on wet-ink signatures and physical filing cabinets, you aren’t just losing time— you’re also increasing your costs and operational stress.

updateGst

India’s Year-End Learning Report: What 2025 Means for Education CSR in 2026

As we conclude a landmark year, India’s education sector stands at an inspiring crossroads. We have successfully achieved historic milestones in school enrollment and higher education participation—a testament to the collective will of our nation.

Today, more children are in classrooms than ever before. For the Corporate Social Responsibility (CSR) community, this success marks the beginning of an even more impactful journey.

How Banks & NBFCs Should Prepare for the New Compliance & Reporting Framework

India’s KYC and customer data infrastructure is undergoing a significant change. CKYC 2.0 (Central KYC Registry 2.0) is not simply a small system update; it introduces a major upgrade in how CKYC data is stored, validated, and governed across the BFSI (Banking, Financial Services, and Insurance) sector.

A Complete Guide to PAN Card Fees in India

Getting your financial identity in order often starts with a PAN, a government-issued identifier that plays a key role in many banking, investment, and tax-related processes in India. The Permanent Account Number (PAN) is an essential ten-character alphanumeric identifier issued by the Income Tax Department for individuals and entities engaged in various tax and high-value financial transactions in India.

How to Secure Your PAN Card with Aadhaar e-KYC

The traditional days of photocopies, physical signatures, and long courier waits are rapidly fading as digital identity takes center stage in India's financial landscape. Getting your PAN Card is no longer a marathon but a swift, digital sprint thanks to the integration of Aadhaar e-KYC. By leveraging the data already verified by the UIDAI, you can now skip the paperwork entirely and secure your permanent account number in record time.

Lost Your Physical PAN? Here’s the Documents Required for PAN Card Reprint

Losing a wallet is a stressful experience that often leaves you scrambling to list every essential document that vanished along with it.

Among those essentials, your PAN card is perhaps the most critical for your financial life, acting as the primary key for banking, tax filings, and high-value transactions.