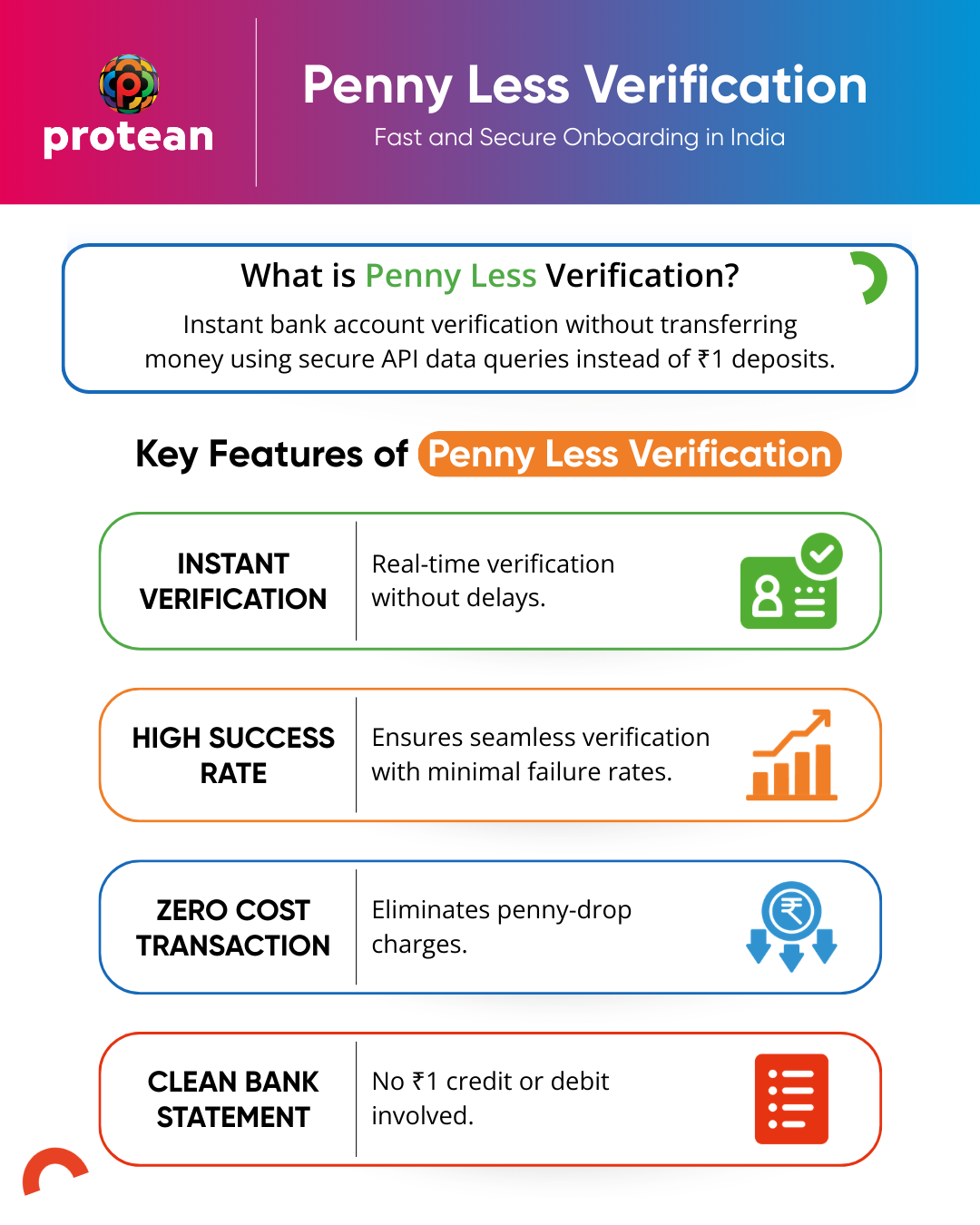

Penny Less Verification: Instant Bank Account Verification

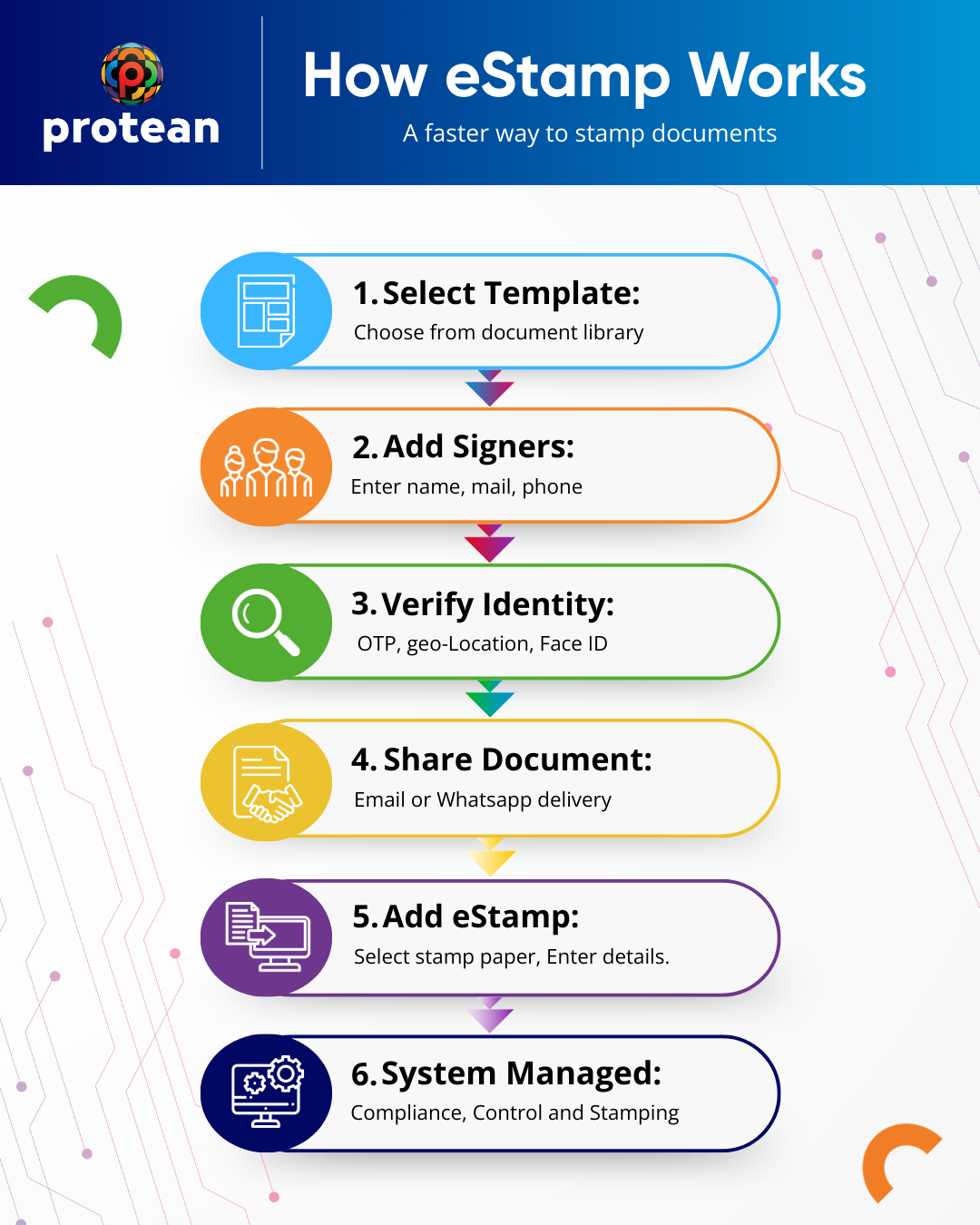

How eStamp Works: Simple & Secure Digital Stamping Process

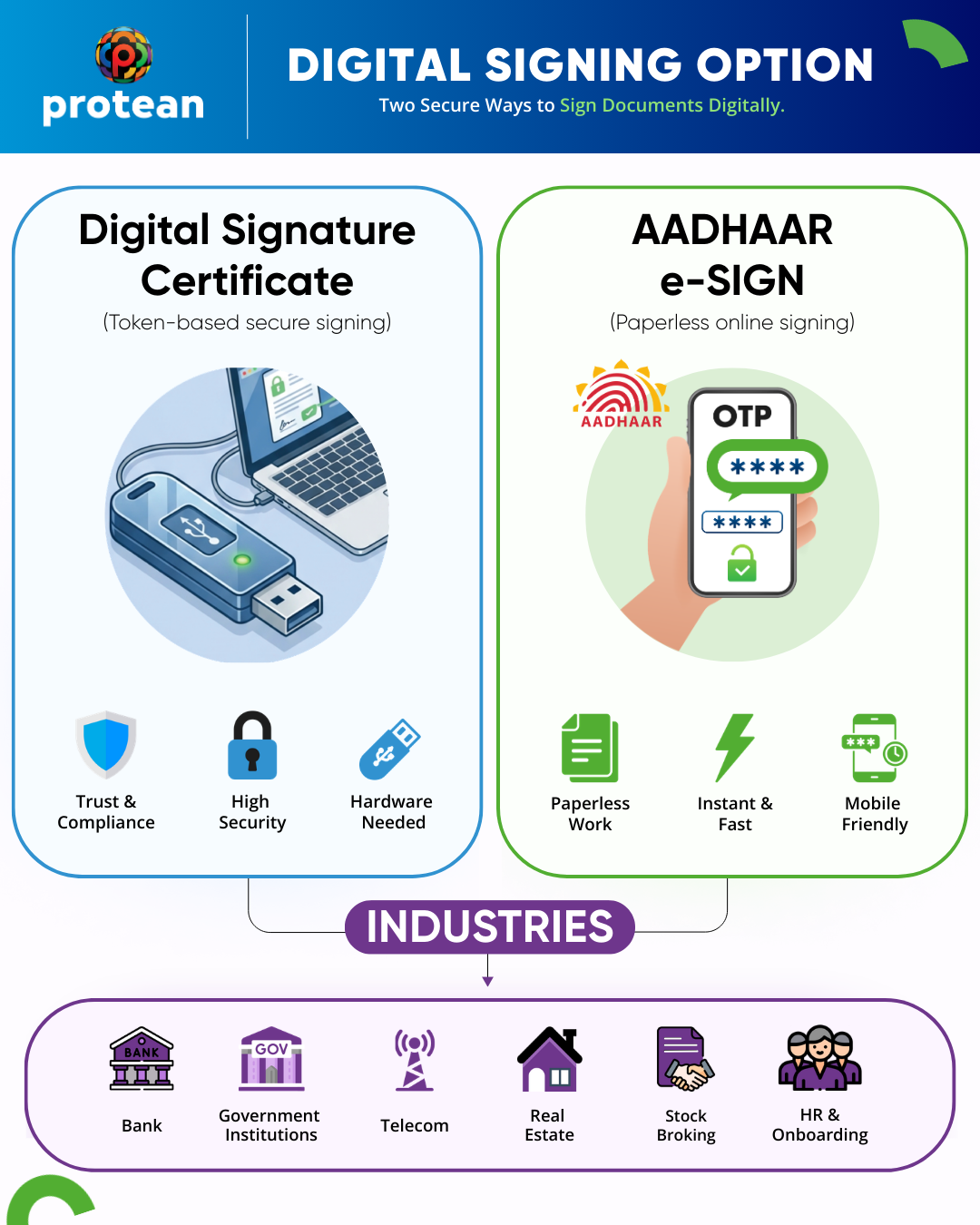

Digital Signing Options: DSC & Aadhaar e-Sign Solutions

Why Scholarships are the Engine of Modern CSR in India

We often search for the "perfect" intervention—one that is measurable, scalable, and capable of changing a life forever.

While infrastructure and digital tools have their place, there is one lever that has consistently proven to be the most direct route to impact: the scholarship.

For a student standing at the crossroads of aspiration and financial hardship, a scholarship is more than just a bank transfer.

It is the difference between dropping out to support the family and staying in school to lead that family into a new era of prosperity.

Hybrid Cloud And Multi-Cloud: Getting The Best of Both Worlds

If you’re leading IT, security, or digital delivery, cloud choices stop being “platform decisions” and start becoming business decisions. The strategy you pick directly affects time-to-market, how quickly teams can release, scale, and respond to demand, along with the size of your risk surface as apps and data span more services and integrations. It also shows up in audits: fragmented controls, inconsistent logging, or unclear ownership can quickly turn into repeat findings.

Virtual Private Cloud Security Best Practices: Routing, Access Control That Stand Up to Audits and Compliance

Most leaders don’t need a refresher on what a VPC is. What matters is whether your VPC design produces repeatable security outcomes: predictable traffic paths, controlled access, and evidence you can stand behind in audits. In regulated Indian environments, that also means your routing and access model must support sovereign expectations; you should be able to show who can reach what, through which paths, and under which approvals, without relying on tribal knowledge.

Know the Best NPS Advantage for All Citizens in 2026

Are you tired of losing your hard-earned savings to rising inflation?

Planning for a relaxed, stress-free retirement is no longer a distant goal; it is a vital necessity for everyone.

Today, traditional bank savings simply aren't enough to secure your future. That is exactly where the National Pension System (NPS) steps in as your ultimate financial safety net.

Key Things to Consider Before You Submit Your NPS Withdrawal Form

Retirement is the start of a beautiful, stress-free chapter where you finally enjoy the rewards of your lifelong hard work.

If you have been investing in the National Pension System (NPS), you have already built a strong financial safety net for your golden years.

Cloud Adoption in Banking: Drivers, Challenges, And Next Steps

Cloud adoption in banking is no longer just a “technology upgrade” conversation. If you’re responsible for delivery, risk, or operations, you’re likely looking at how cloud-based services can improve agility without weakening control.

The real question is how to move to cloud solutions in a way that fits Indian banking realities, such as regulatory expectations, legacy estates, and strict security posture.

Private Cloud For Data Security: Storage, Access Control, And Audit Readiness

When you handle regulated or high-impact data, cloud decisions are judged on governance as much as performance. A private cloud can help you enforce stronger control over data residency, storage configuration, and access pathways, while still supporting modern cloud-based services.

This matters for workloads such as KYC and identity records, financial transactions, healthcare data, telecom subscriber information, and high-value intellectual property, where auditability and accountability are essential. Security, however, is not automatic.