SaaS Platform Migration: De-Risk Tool Changes Without Data Loss

Switching tools can look straightforward on a slide but become expensive in practice. A SaaS platform sits inside workflows, integrations, reporting, and compliance evidence, so a careless migration can create revenue leakage, compliance exposure, and loss of decision trust.

How to Explain the New 80% NPS Withdrawal Rule to Retiring Employees in 2026

The updated NPS withdrawal rules have transformed retirement planning in India. The Pension Fund Regulatory and Development Authority (PFRDA), in its December 2025 amendments, introduced a new rule allowing up to an 80% lump sum NPS withdrawal for non-government subscribers.

Why Your NPS Tier 2 Account is a Hidden Gem for Wealth Creation

The National Pension System is a flexible, long-term retirement wealth creator of the modern financial age.

It offers a dual-account structure defining this unique financial vehicle.

Why ₹8 Lakh is the New "Magic Number" for Your NPS Retirement Planning in 2026

Are you looking for NPS retirement planning benefits on the internet? Here is a magic number for investors to consider in 2026 to transform their retirement planning.

The Corporate Employee’s Guide to the NPS in 2026-27

The National Pension System (NPS) is a powerful tool for the modern corporate workforce. However, it is also an underutilised one.

The current financial scenario is hinting at a shift towards market-linked growth. The NPS scheme can provide this opportunity through diversified asset allocation. Market-linked instruments can offer superior compounding potential over long decades of service.

NPS Vatsalya or Sukanya Samriddhi: Comparison Every Parent Needs in 2026

As a parent, you are the architect of your child’s future.

Every small step you take today is a building block for their biggest milestones—whether it’s supporting their passion for a world-class education or giving them the freedom to start their own venture one day.

For decade, the Sukanya Samriddhi Yojana (SSY) has been a beloved choice, offering a secure and tax-efficient way to save for a daughter’s future.

Should You Choose NPS Vatsalya or Mutual Funds for Your Child?

Every parent shares a common dream: providing their child with a life full of opportunities, a top-tier education, and a secure financial head start.

In the past, this usually meant opening a simple savings account or buying gold.

However, in 2026, the financial landscape has evolved. With the launch of NPS Vatsalya, the government has introduced a powerful new way to save for your child’s long-term future.

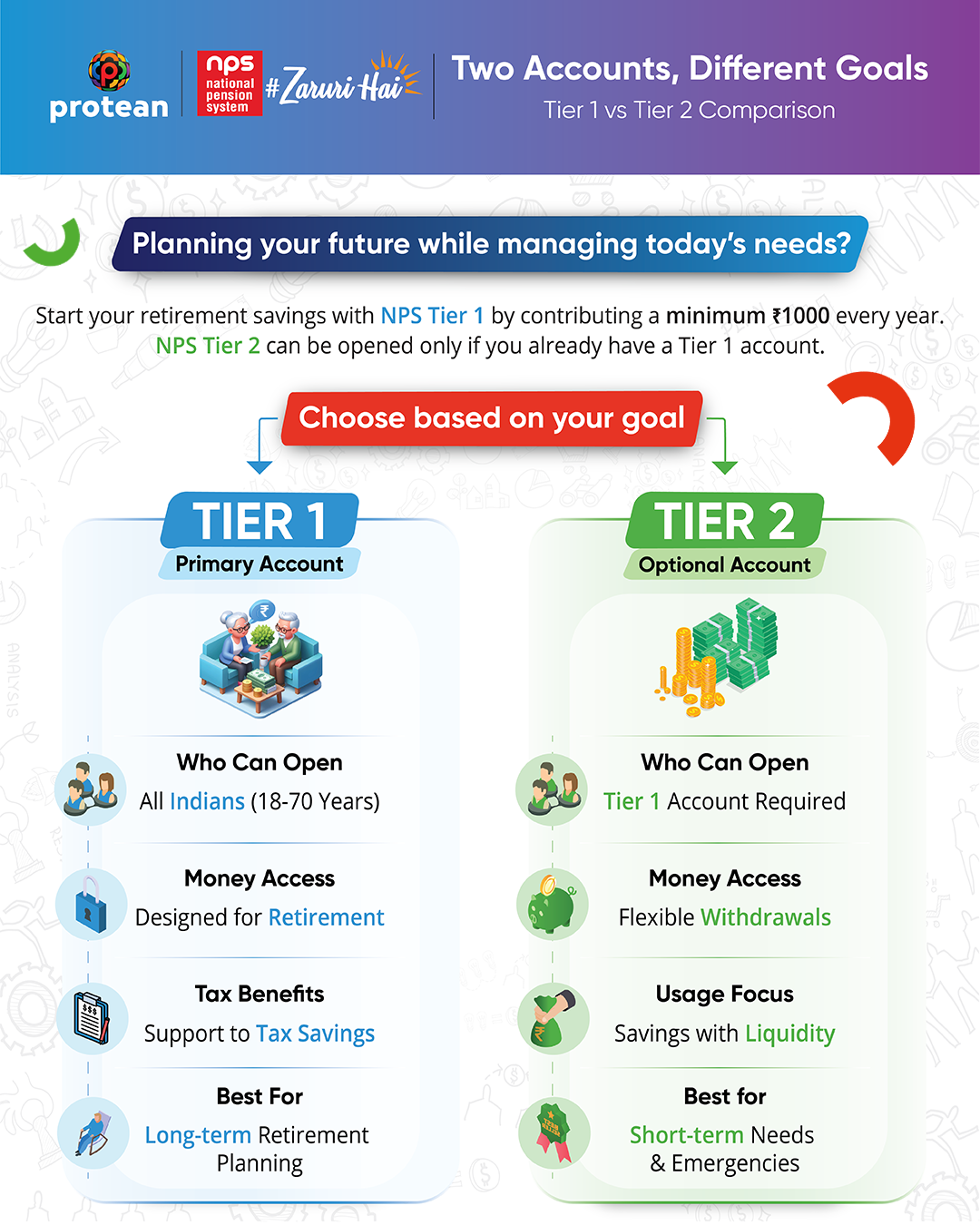

NPS Tier 1 vs Tier 2 Account: Key Differences, Benefits

Selecting Between NPS Tier 1 and Tier 2 Accounts

How to Evaluate a SaaS Platform in India: Security, Sovereignty, Reliability, Cost, And Integrations

Choosing a SaaS platform is no longer a feature comparison for leadership teams. In organisations, it shapes workflow continuity, data governance, audit exposure, and how quickly teams scale without firefighting operations.

If you pick the wrong tool, you don’t just lose time; you inherit operational risk, messy integrations, and compliance headaches that surface later when the business has already grown dependent on it.

Aadhaar Biometric Update After 5 & 15 Years – Mandatory Update Guide for Children & Adults (2026)

Did you know that Aadhaar biometrics must be updated at certain stages of life?

Many citizens are unaware that children enrolled in Aadhaar before the age of 5 and 15 are required to update their biometric details. Updating biometrics ensures accurate authentication and prevents issues in the future.

This guide explains who needs biometric updates, when to do it, documents required, fees, and the complete process.

Why Is Biometric Update Important?

Aadhaar captures biometric details such as: