1. What is the National Pension System (NPS)?

The National Pension System (NPS) is a voluntary, defined contribution retirement savings plan. Individuals contribute to their accounts during their working years to build a corpus for retirement income. NPS is mandatory for Central Government employees (except armed forces) hired after January 1, 2004.

2. What are the key features of NPS?

- Regulated: Governed by PFRDA (Pension Fund Regulatory and Development Authority).

- Accessible: Open to Indian citizens, residents, non-residents, and OCIs.

- Low Cost: One of the most affordable pension schemes globally.

- Flexible: Choice of Point of Presence (PoP), Central Recordkeeping Agency (CRA), Pension Fund, and asset allocation, which can be changed later.

- Portable: Account can be transferred across jobs and locations.

- Tax Efficient: Offers tax benefits under the Income Tax Act, 1961.

- Market-Linked Returns: Investment returns depend on market performance and your chosen investment option.

- Transparent: 24/7 online account access and mandated public disclosures.

3. Who is eligible to join NPS?

- Indian Citizens (resident or non-resident)

- Overseas Citizens of India (OCI)

- Aged between 18 and 70 years

- Compliant with Know Your Customer (KYC) norms

HUFs and PIOs are not eligible. NPS is an individual account and cannot be opened for a third party.

4. Can I join NPS if I already contribute to other retirement plans like EPF, PPF, or Superannuation Fund?

Yes, you can voluntarily join NPS even if you contribute to other retirement plans. However, you cannot have multiple NPS accounts.

5. How much pension will I receive from NPS?

Your pension amount depends on your contributions, investment returns, and the annuity plan you purchase at retirement. NPS does not guarantee a specific benefit amount, as investments are subject to market risks.

6. What is the All Citizen Sector in NPS?

NPS covers various sectors: Central Government, State Government, Corporate, and All Citizen. Individuals joining NPS voluntarily belong to the All Citizen Sector.

7. What is the structure of NPS, and why are there different intermediaries involved?

NPS has a unique structure with specialized intermediaries: PoP, Pension Fund, CRA, Trustee Bank, Annuity Service Provider, Retirement Advisors, Custodian, and NPS Trust. This ensures cost efficiency and safeguards subscriber interests by limiting each intermediary's control.

8. What are the charges associated with NPS?

NPS involves various charges levied by different intermediaries. Understanding these costs is crucial for effective financial planning. The charges are categorized below:

8a. Point of Presence (PoP) Charges:

- Subscriber Registration: ₹200 to ₹400 (negotiable within this slab). Collected upfront.

- Initial Contribution/Subsequent Transactions: 0.5% of the contribution amount, Minimum ₹30, Maximum ₹25,000 (negotiable within this slab).

- Subsequent Transactions (Non-Financial): ₹30 per transaction.

- Contribution through eNPS/D-Remit (All Citizen and Tier-II): 0.20% of the contribution amount, Minimum ₹15, Maximum ₹10,000.

- Withdrawal/Exit Processing: 0.125% of the corpus, Minimum ₹125, Maximum ₹500.

- Persistency Charges (All Citizen Only):

- ₹50 per annum for annual contributions between ₹1,000 and ₹2,999.

- ₹75 per annum for annual contributions between ₹3,000 and ₹6,000.

- ₹100 per annum for annual contributions above ₹6,000. Deducted through cancellation of units.

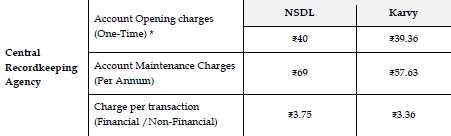

8b. Central Recordkeeping Agency (CRA) Charges:

There are two CRAs: Protean and KFin Technologies Limited. Their charges vary slightly.

To get updated information on this, check out the answer to question 12-14 on NPS Vatsalya.

8c. Pension Fund Charges:

- Investment Management Fee: 0.0467% - 0.09% p.a. of the investment value, adjusted in the NAV of the scheme.

8d. Other Charges:

- NPS Trust (Reimbursement of Expenses): 0.005% p.a. of assets managed.

- Custodian (Asset Servicing Charges): 0.000000001770% p.a. of assets in custody.

Important Notes:

- Tier-II transaction charges are the same as Tier-I.

- Charges are subject to change as per PFRDA regulations. Refer to the latest PFRDA circulars for the most up-to-date information.

9. How can I open an NPS account?

- Through a registered Point of Presence (PoP) – online or offline. Visit the PFRDA website for a list of PoPs.

- Online through the eNPS platform of NPS Trust.

| Manage your NPS account contributions and investments with ease - explore our comprehensive guide for online and offline options. |

- Story by Bruhadeeswaran R.