When it comes to planning for your long-term investments in India, you have a variety of options to consider for meeting your financial goal for retirement corpus. Among these options are the National Pension Scheme (NPS), Public Provident Fund (PPF), and Employees Provident Fund (EPF). Each of these investment avenues offers unique attributes, catering to different types of investors. In this article, you will explore the offerings of NPS, EPF, and PPF to help you determine which one best suits your financial needs and requirements.

What is the National Pension Scheme (NPS)?

NPS is a retirement savings scheme introduced by the Government of India and is regulated by the Pension Fund Regulatory and Development Authority (PFRDA). If you are an Indian citizen aged 18 to 70, you can easily open an NPS account through Protean. Protean is the CRA of NPS and it ensures that the onboarding experience of the subscribers is seamless.

NPS provides flexibility by letting you choose investment strategies and fund managers that match your risk tolerance and financial goals. It caters to all types of investors, whether you are looking for aggressive growth or prefer a safer approach. When you retire, you can withdraw up to 60% of your savings as a lump sum. The remaining 40% must be used to purchase an annuity scheme from an approved provider. This annuity scheme will give you regular pension payments after your retirement.

Features and Benefits of NPS

The following are the features and benefits of NPS:

1. Investment Options

NPS allows subscribers to choose from different investment instruments including equity, corporate bonds, government bonds, and alternate products. When investing your money, you can choose between two options depending on your risk appetite and financial goals:

- Active Choice: You can decide how to allocate your NPS account's assets based on your risk tolerance and financial needs, within certain limits

- Auto Choice: Allocation of assets is done automatically based on your age, without you having to decide.

2. Liquidity

The NPS scheme has two types of accounts based on liquidity: Tier-1 and Tier-2. Tier-1 accounts have a lock-in period until retirement, meaning you cannot withdraw until you retire. Tier-2 accounts are more flexible and allow withdrawals as needed.

3. Contributions

To open a Tier-1 NPS account, you need a minimum of Rs. 500, and the minimum annual contribution is Rs. 1,000. You must make at least one transaction per year to keep your account active.

What is the Employee Provident Fund (EPF)?

In the EPF scheme, both you and your employer contribute 12% of your basic salary and dearness allowance every month. These contributions build up over time, forming a substantial savings fund for your retirement. Usually, this fund is used to support you financially after your retirement. However, you have the option to withdraw part of your EPF under specific circumstances.

You will receive a unique Universal Account Number (UAN) from the Employee Provident Fund Organisation (EPFO). This number remains valid for your entire working life, and your EPF account is linked to it. Due to this reason when you switch jobs, you do not need to apply for the transfer of your EPF account.

Features and Benefits of EPF

Here are some crucial features and benefits of EPF:

1. Interest Rates

Your EPF account earns an interest rate of 8.25% p.a., which is subject to annual revisions by the CBT & EPFO under the finance ministry's supervision. This interest is directly credited to your EPF account every year.

2. Liquidity

EPF is not very liquid because you can only withdraw money in specific situations like higher education, marriage, or buying a house.

3. Flexibility

If you change jobs, you can smoothly transfer your EPF account from one office to another using your Universal Account Number (UAN).

What is the Public Provident Fund (PPF)?

A PPF is a government-backed scheme whose main goal is to assist people in saving small amounts and offer returns on those savings. This scheme comes with an attractive interest rate, and you do not have to pay any tax on the returns generated from the interest.

Any Indian citizen can open a PPF account. Parents or guardians can also open accounts for minors. To start saving in the PPF investment scheme, you must open a PPF account at the post office or specific branches of public and private sector banks. Moreover, you can claim deductions under Section 80C for up to Rs. 1.5 lakh in a financial year.

Features and Benefits of PPF

Here are the features and benefits of PPF that you should know:

1. Loan Facility

You can take a loan against your PPF investments. This option is available from the third financial year to the end of the sixth year. The maximum loan amount is 25% of the account balance from the previous year. The interest rate on a loan against your PPF account is 1% higher than the interest rate on your PPF account.

2. Premature Exit Facility

You can exit the PPF account prematurely after 5 years for emergency needs like medical treatment or higher education. However, there is a 1% deduction from the applicable interest rate for the period you have subscribed to this facility.

3. Investment Limits

You need a minimum of Rs. 500 to invest in a PPF account per year. The maximum limit for investments is Rs. 1.5 lakh per year.

4. Low-risk Investment

PPF investments are very low risk because the government guarantees the interest payments and principal invested.

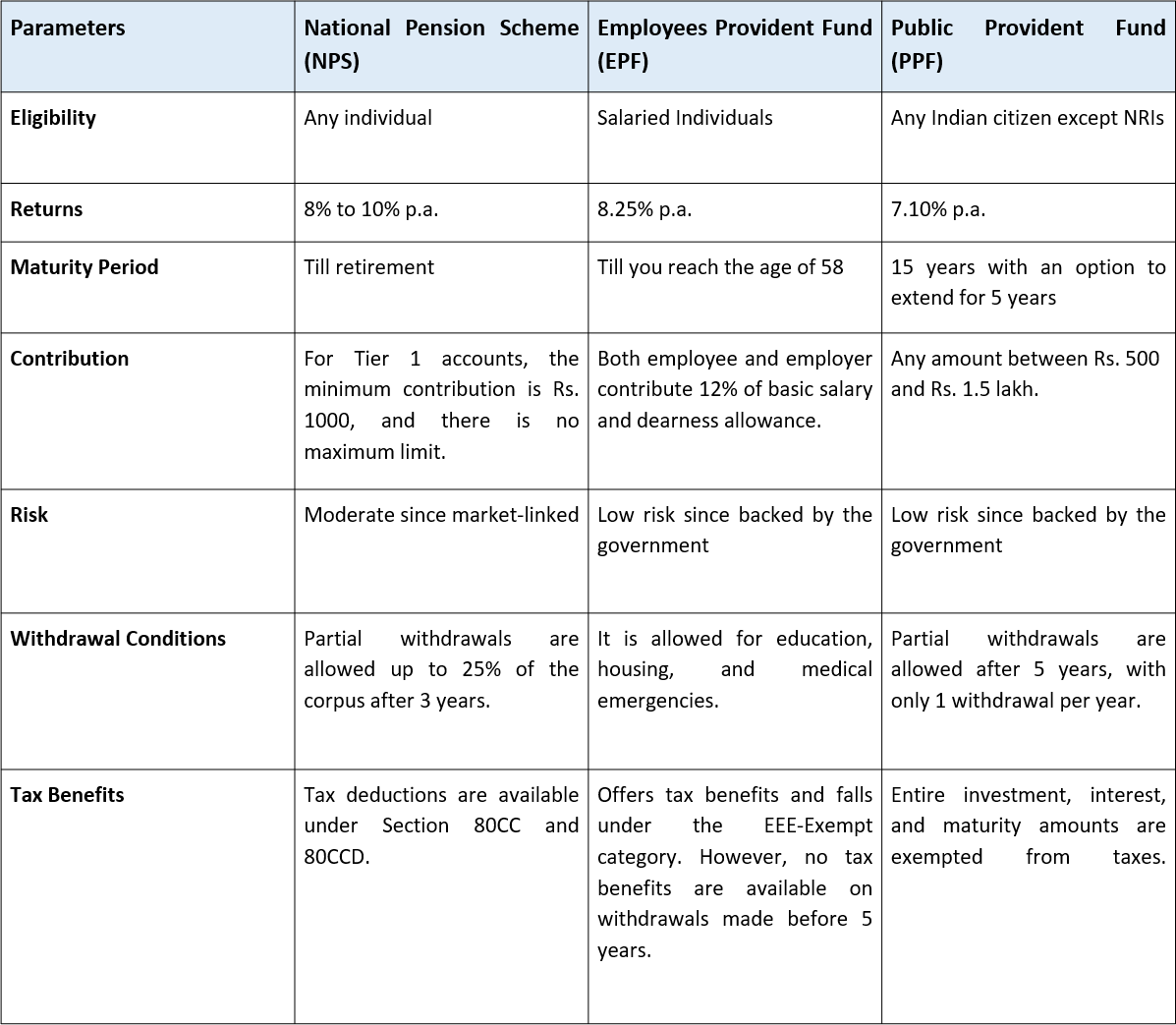

Comparison of NPS, EPF and PPF

The following table highlights the differences between NPS, PPF and EPF:

Conclusion

After comparing NPS, PPF, and EPF, it is clear that each option comes with its unique benefits. When deciding which option is best for you, consider the above-mentioned feature and evaluate your circumstances and financial goals carefully. By doing so, you can make an informed decision and choose the investment option that aligns most closely with your individual needs.

| Simplify your NPS contributions and optimize your investment strategy – learn more with our detailed guide. |

- Story by Kakoli Laha