Discover the surprising truth about NPS vs other investments and find out which strategy will help you grow your wealth.

Why NPS Stands Out in Your Retirement Portfolio

Introduction:

In the world of investments, the National Pension System (NPS) has gained significant popularity as a retirement savings option. However, many investors are torn between choosing NPS and other traditional investments like stocks, bonds, and mutual funds to grow their portfolio. In this blog post, we'll dive into the comparison of NPS against other investment options to understand why NPS stands out in a retirement portfolio.

Performance:

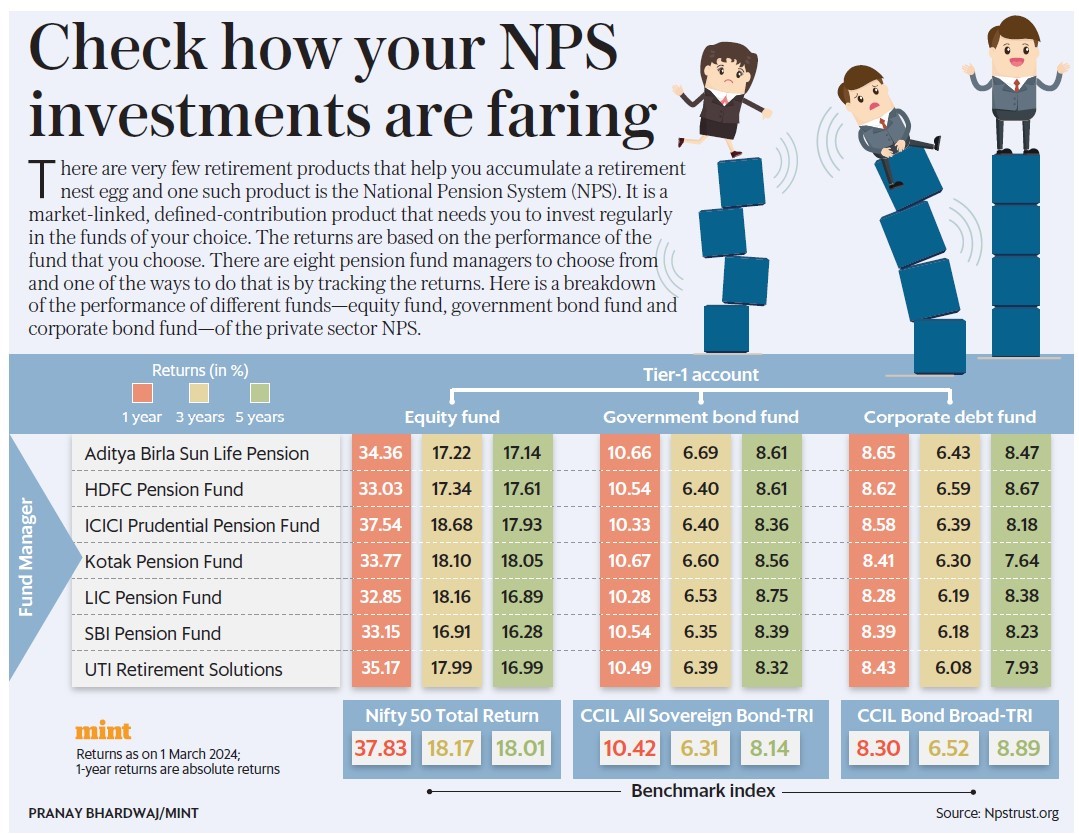

When it comes to performance, historical data shows that NPS has provided competitive returns compared to other investment avenues. While stocks may offer higher returns, they also come with higher volatility. NPS, on the other hand, has shown stable growth over the years, making it an attractive option for risk-averse investors looking for steady returns.

Source: Livemint.com

The infographic above displays benchmark returns of Nifty50, Sovereign Bond, and Corporate Bond, showing almost comparable returns. However, the tax benefits associated with investing in NPS are expected to contribute to a faster growth of the retirement portfolio.

Tax Benefits:

One of the key advantages of investing in NPS is the tax benefits it offers. Contributions made to NPS are eligible for a deduction under Section 80C of the Income Tax Act, providing investors with an additional avenue for tax savings. Additionally, withdrawals from NPS at retirement are tax-free, making it a tax-efficient investment option compared to stocks and bonds.

Investment Flexibility:

Flexibility is another factor that sets NPS apart from other investment instruments. Investors can choose their contribution amounts and have the flexibility to adjust their investment strategy over time. NPS also allows for partial withdrawals in case of emergencies, offering a level of liquidity that may be lacking in other retirement accounts.

Cost and Fees:

When comparing the costs associated with investing in NPS versus other retirement accounts like stocks and mutual funds, NPS typically comes out ahead in terms of lower fees and charges. The total cost of investing in NPS over the long term is often lower than that of other retirement options, making it an attractive choice for cost-conscious investors.

Suitability for Retirement Portfolio:

NPS can play a crucial role in diversifying a retirement portfolio. By adding NPS to a mix of stocks, bonds, and other investments, investors can achieve greater diversification and reduce overall portfolio risk. NPS's stable returns and tax benefits make it a valuable component in a well-rounded retirement savings strategy.

| Simplify your NPS contributions and optimize your investment strategy – learn more with our detailed guide. |

Conclusion:

In conclusion, the National Pension System (NPS) offers a compelling combination of performance, tax benefits, flexibility, and cost-effectiveness that make it a standout choice for retirement investment. While other options like stocks and bonds have their merits, NPS's unique features make it a valuable addition to any investor's retirement portfolio. Consider incorporating NPS into your investment strategy to enjoy the benefits it offers for long-term wealth creation and financial security.

- Story by Kakoli Laha