In today’s fast-paced world of financial planning, one of the most valuable gifts parents can give their children is the habit of saving early. As Finance Minister Nirmala Sitharaman aptly said in her 2024 Union Budget speech, “Building the foundation of financial security begins in childhood.” With the introduction of NPS Vatsalya, a pension scheme specifically designed for minors, parents can establish a secure foundation even before their children reach adulthood. This innovative scheme aims to instil a savings habit in children while securing their financial future.

Latest Data and Insights:

According to a recent article on The Economic Times, NPS Vatsalya is anticipated to provide substantial returns for children upon retirement, with the potential to accumulate over Rs 10 crore by investing Rs 10,000 annually until the child reaches 18 years of age. This underscores the scheme's long-term financial security benefits and compelling investment potential.

This blog will explain the eligibility criteria, benefits, and flexibility of NPS Vatsalya to help parents make informed decisions.

What is NPS Vatsalya?

Launched in July 2024, NPS Vatsalya is a pension scheme tailored for minors. It allows parents or guardians to open a Permanent Retirement Account Number (PRAN) so that their child can build a retirement corpus over time. Contributions made to the NPS Vatsalya account are invested in various asset classes, such as equity and government securities, helping the corpus grow through compounding over the long term.

The core philosophy of NPS Vatsalya is to create financial security for minors, not just for their retirement but also by inculcating disciplined saving habits.

For more details about the scheme and how to invest online and offline, you can refer to the NPS Contribution Guide.

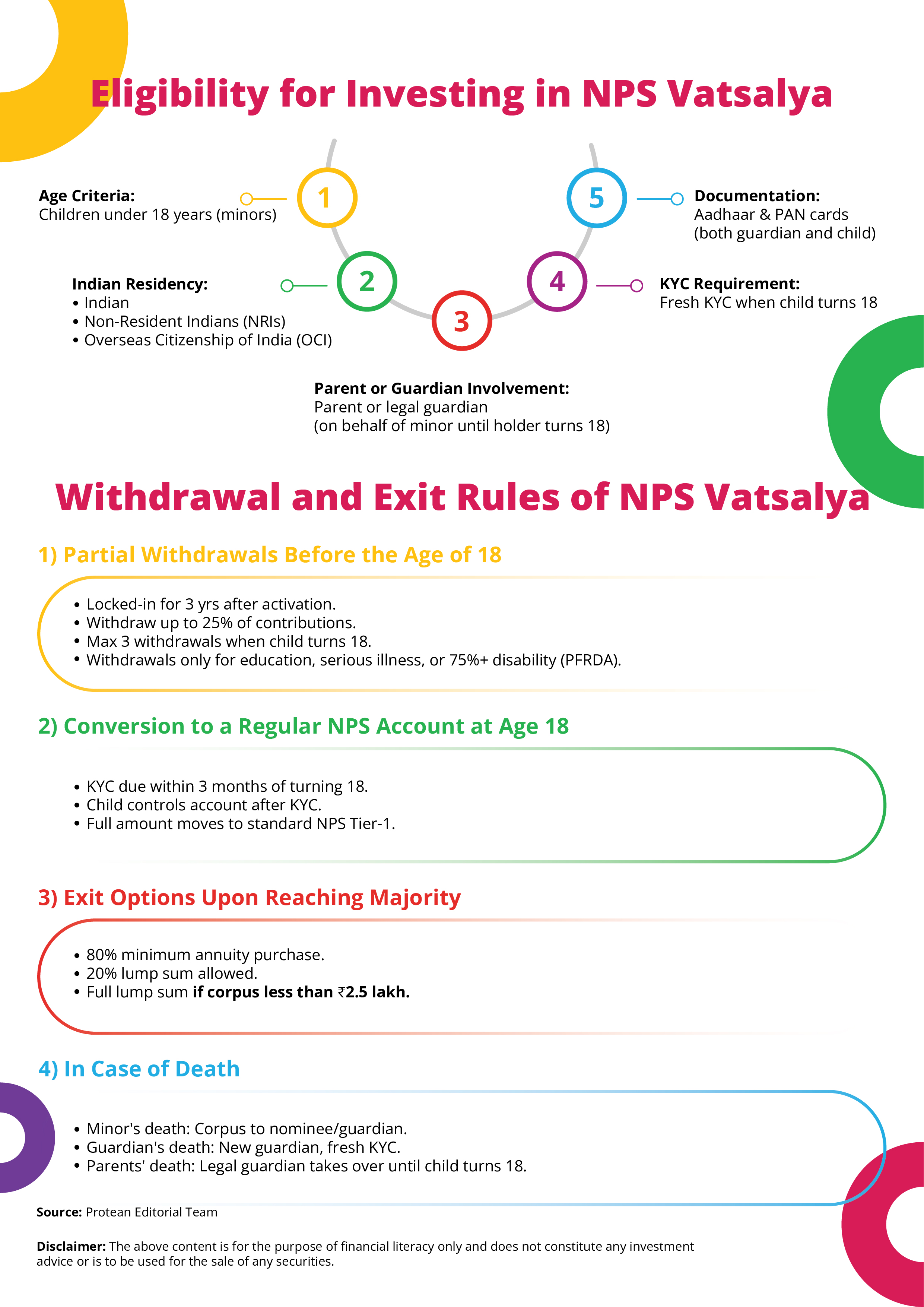

Eligibility for Investing in NPS Vatsalya

The eligibility for investing in NPS Vatsalya is designed to include a broad demographic of young individuals. Here are the essential requirements:

- Age Criteria: Children under 18 years (minors) are eligible.

- Indian Residency: Both Indian citizens, Non-Resident Indians (NRIs), and Overseas Citizenship of India (OCI) minors can apply.

- Parent or Guardian Involvement: A parent or legal guardian must open and operate the account on behalf of the minor. The guardian is responsible for making contributions until the child reaches the age of 18.

- KYC Requirement: The account will undergo a fresh KYC when the child turns 18, after which the account can be transferred to the standard NPS Tier-1 scheme.

- Documentation: Documents such as Aadhaar and PAN cards are required to open an NPS Vatsalya account. Both the guardian’s and the child’s documents must be submitted. Check the detailed documents required here

Benefits of Investing in NPS Vatsalya

1. Long-Term Financial Security

NPS Vatsalya enables parents to build a robust retirement fund for their children, ensuring they have a solid financial cushion when they reach adulthood. By starting early, parents can gradually accumulate wealth over the years, allowing the corpus to grow through long-term investments. This provides financial security for the child, whether for future educational needs, unforeseen circumstances, or retirement.

2. Affordable Contributions

One of the standout features of the NPS Vatsalya plan is its accessibility. The scheme allows for a minimum contribution of ₹1,000 per annum, making it feasible for families from all financial backgrounds. There is also no upper limit on contributions, offering flexibility for parents who wish to contribute more toward securing their child's future.

3. Cultivating Financial Responsibility

NPS Vatsalya also plays an educational role. By involving children in the process of saving from a young age, parents can instil valuable lessons about financial planning, discipline, and long-term investment.

4. Protection Against Uncertainty

NPS Vatsalya acts as a financial safety net for children, providing financial stability even in challenging times. Whether it’s the untimely demise of a parent or a sudden financial hardship, the contributions made to the scheme ensure that the child’s future is protected.

5. Flexibility in Contributions

Whether you want to contribute a fixed annual amount or increase your contributions over time, the plan allows you to tailor your savings according to your family’s evolving financial needs. This flexibility ensures that parents can stay committed to their financial goals without feeling burdened.

6. Encouraging Long-Term Investment

By contributing consistently over many years, parents can grow a substantial corpus for their child’s future. This habit of long-term investment is one of the key pillars of financial success, allowing the investment to withstand market fluctuations.

7. Power of Compound Interest

The NPS Vatsalya scheme leverages the power of compounding, allowing the corpus to grow exponentially over the years. The earlier parents start saving, the more they can benefit from compound interest. A small contribution made regularly can turn into a significant sum by the time the child reaches adulthood

For detailed information on contributing to NPS Vatsalya online or offline, visit here

Withdrawal and Exit Rules of NPS Vatsalya

The NPS Vatsalya Scheme offers flexibility for parents or guardians to make partial withdrawals before the child turns 18. Here are the key rules governing withdrawals and exits from the scheme:

1. Partial Withdrawals Before the Age of 18

Parents or guardians managing the NPS Vatsalya account can make partial withdrawals under the following conditions:

- Minimum Lock-in Period: Withdrawals are allowed after the account has been active for at least 3 years.

- Withdrawal Limit: Parents or guardians can withdraw up to 25% of the total contributions made.

- Frequency of Withdrawals: A maximum of 3 withdrawals are permitted before the child turns 18.

- Permitted Uses for Withdrawal: Withdrawals can be made for specific purposes such as the child’s education, treatment of serious illnesses, or in case of disability exceeding 75%, as outlined by the PFRDA (Pension Fund Regulatory and Development Authority).

2. Conversion to a Regular NPS Account at Age 18

Once the child reaches the age of 18, the NPS Vatsalya account can be seamlessly converted into a regular NPS account. The following rules apply:

- Fresh KYC: The subscriber (child) must complete a new KYC process within 3 months of turning 18.

- Account Management: After KYC completion, the child gains full control over the account and can continue contributing towards their retirement savings.

- Transfer of Contributions: The entire accumulated corpus from the NPS Vatsalya account will be transferred to the standard NPS Tier-1 account under the All Citizen Model.

3. Exit Options Upon Reaching Majority

When the child turns 18, they have the option to exit the scheme instead of converting it into a regular NPS account. Here are the exit rules:

- Annuity Purchase Requirement: At least 80% of the accumulated funds must be invested in an annuity plan to ensure future pension benefits.

- Lump Sum Withdrawal: The remaining 20% of the corpus can be withdrawn as a lump sum.

- Exception: If the total accumulated corpus is less than ₹2.5 lakh, the entire amount can be withdrawn in a lump sum without the requirement to invest in an annuity.

4. In Case of Death

The NPS Vatsalya Scheme provides clear guidelines in case of the unfortunate death of the subscriber or the guardian:

- Death of the Subscriber (Minor): In the event of the minor child’s death, the entire corpus will be returned to the nominee, who is typically the guardian.

- Death of the Guardian: If the guardian passes away, a new guardian must be registered for the account by completing a fresh KYC process.

- Death of Both Parents: If both parents or guardians pass away, the child’s legal guardian can take over management of the account without the need to continue contributions until the child turns 18.

How to Apply for NPS Vatsalya?

Parents and guardians can apply for NPS Vatsalya online or offline. The process is straightforward, requiring basic documents such as Aadhaar and PAN. The Pension Fund Regulatory and Development Authority (PFRDA) is the regulatory body overseeing the scheme, ensuring transparency and secure management of investments.

Application Steps:

- Gather Required Documents: Ensure you have the necessary documents like Aadhaar and PAN cards for both the guardian and the child.

- Choose Application Mode: Decide whether to apply online through the official eNPS portal or offline via authorized banks and financial institutions.

- Fill Out the Application Form: Complete the required details accurately.

- Submit Documents: Attach the necessary documents as per the guidelines.

- Verification and Approval: The application will undergo verification by the PFRDA for approval.

Conclusion

The NPS Vatsalya scheme is a revolutionary scheme designed to secure the financial future of minors. With flexibility in contributions, tax benefits, and a long-term wealth accumulation strategy, this scheme is a perfect way for parents to secure their children's financial future.

| Start investing today to secure your child’s financial future. |

For all your common questions, here are brief and specific answers.

Opening of NPS Vatsalya Account

Contributing to NPS Vatsalya Account

About NPS Vatsalya Account Withdrawals And Exits

-