The 2024 Union Budget introduced NPS Vatsalya, a pension plan for minors, available nationwide. This article compares NPS Vatsalya with traditional savings options like Mutual Funds and the Public Provident Fund (PPF) to help parents choose the best plan for their child.

This blog compares NPS Vatsalya with traditional savings plans like Mutual Funds and the Public Provident Fund (PPF). This data-backed analysis will guide parents in deciding which financial plant best suits their child’s future.

What is NPS Vatsalya?

NPS Vatsalya lets parents/guardians invest for their children's future. Early enrollment allows for long-term growth, potentially leading to better returns than traditional savings plans. NPS returns have historically reached around 9.5% CAGR (government sector) and up to 14% (equity, non-government sector).

Similar to the regular NPS, contributions are invested across equities, corporate bonds, and government securities. This mix potentially offers higher returns than fixed-income options like PPF (currently at 7.1%), according to the Pension Fund Regulatory and Development Authority (PFRDA).

What truly sets it apart is that it provides life-long pension security starting from early adulthood. The scheme combines the safety of government oversight with the potential of market-linked returns, offering an attractive blend of security and growth.

The Importance of Pension Planning

Parents seek long-term financial security for their children. Traditional savings often lack the structure needed for retirement planning. NPS Vatsalya addresses this by offering a systematic retirement savings approach.

The 2024 Union Budget highlighted the growing need for structured pension plans. With rising life expectancy and fewer traditional pensions, NPS Vatsalya allows early savings, leveraging compounding for significant wealth accumulation. A monthly investment of Rs 10,000 per year until age 18 could potentially grow to Rs 11 crore by retirement.

Ready to invest in your child's future? Get started with NPS Vatsalya. |

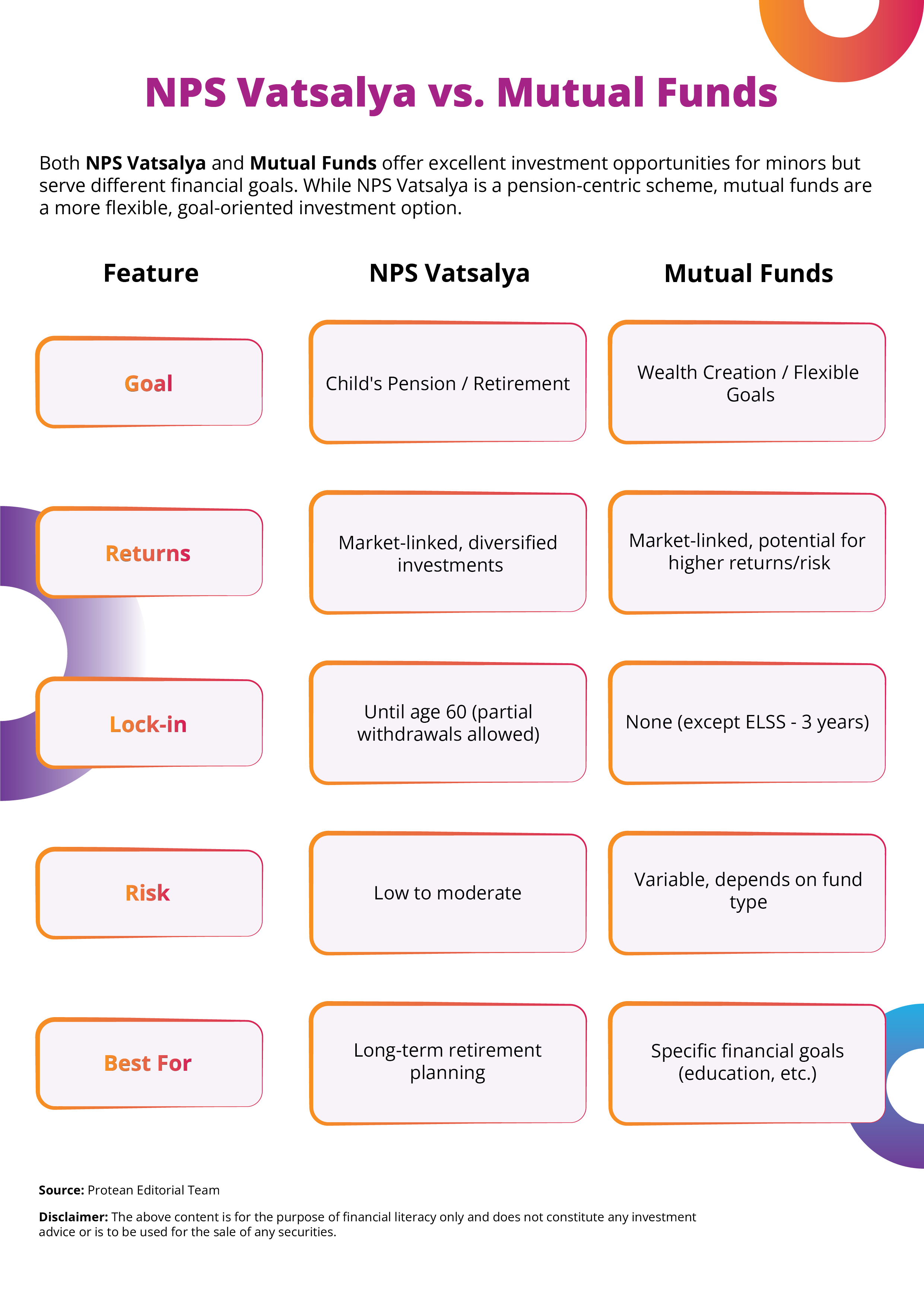

NPS Vatsalya vs. Mutual Funds

Both NPS Vatsalya and Mutual Funds offer excellent investment opportunities for minors but serve different financial goals. While NPS Vatsalya is a pension-centric scheme, mutual funds are a more flexible, goal-oriented investment option.

Here’s a comparison based on key factors:

NPS Vatsalya focuses on retirement, while mutual funds offer investment flexibility.

| Consider NPS Vatsalya for long-term retirement security. |

If you need more flexible investment options for various goals, mutual funds might be suitable.

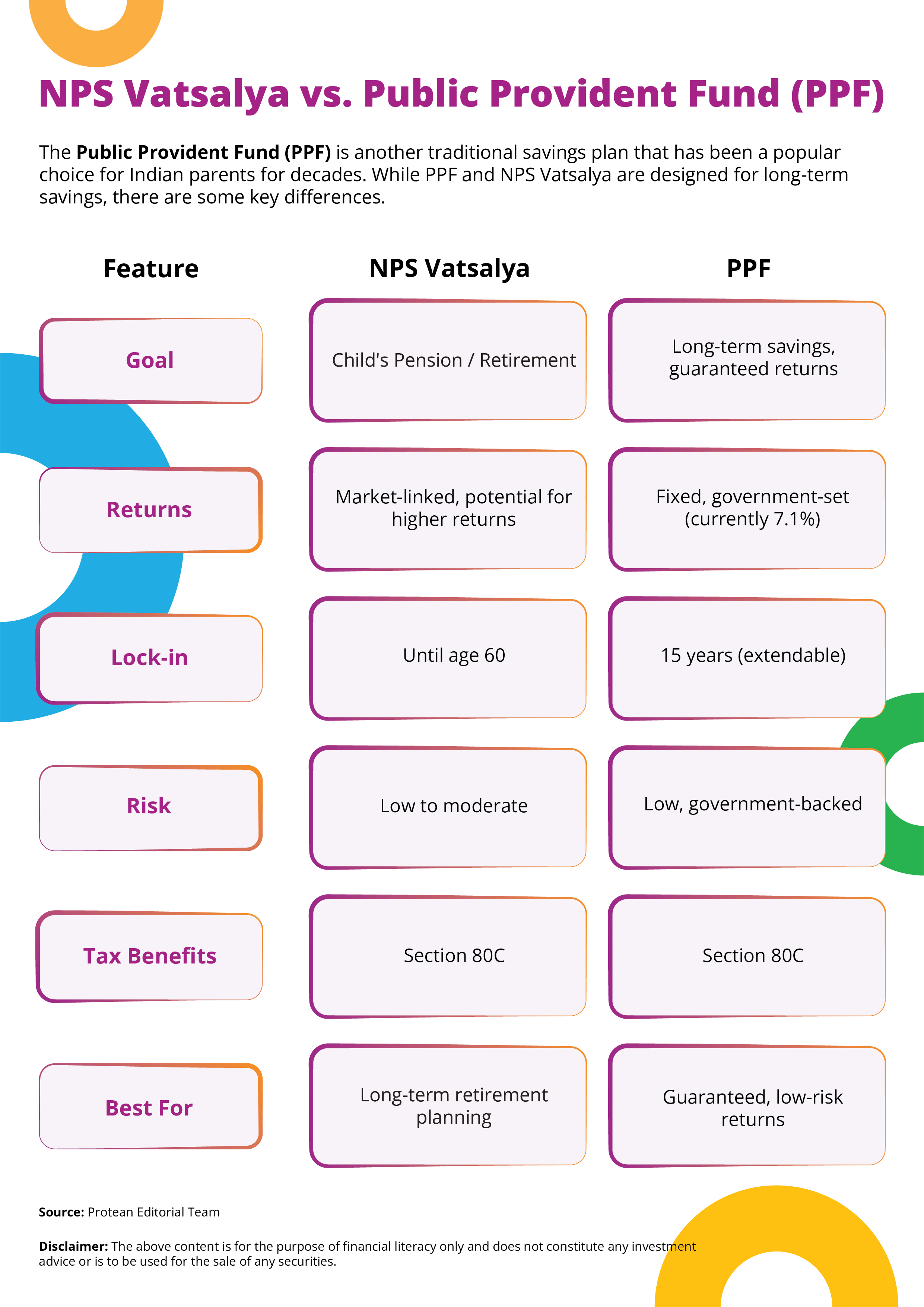

NPS Vatsalya vs. Public Provident Fund (PPF)

The Public Provident Fund (PPF) is another traditional savings plan that has been a popular choice for Indian parents for decades. While PPF and NPS Vatsalya are designed for long-term savings, there are some key differences.

While PPF offers guaranteed, low-risk returns, NPS Vatsalya offers higher gains due to its exposure to equities. However, this comes with a higher risk profile. If security is your primary concern, PPF may be a better option, but if you're looking for long-term growth for your child’s retirement, NPS Vatsalya is worth considering.

For more insights on how NPS Vatsalya compares to PPF, visit Business Today.

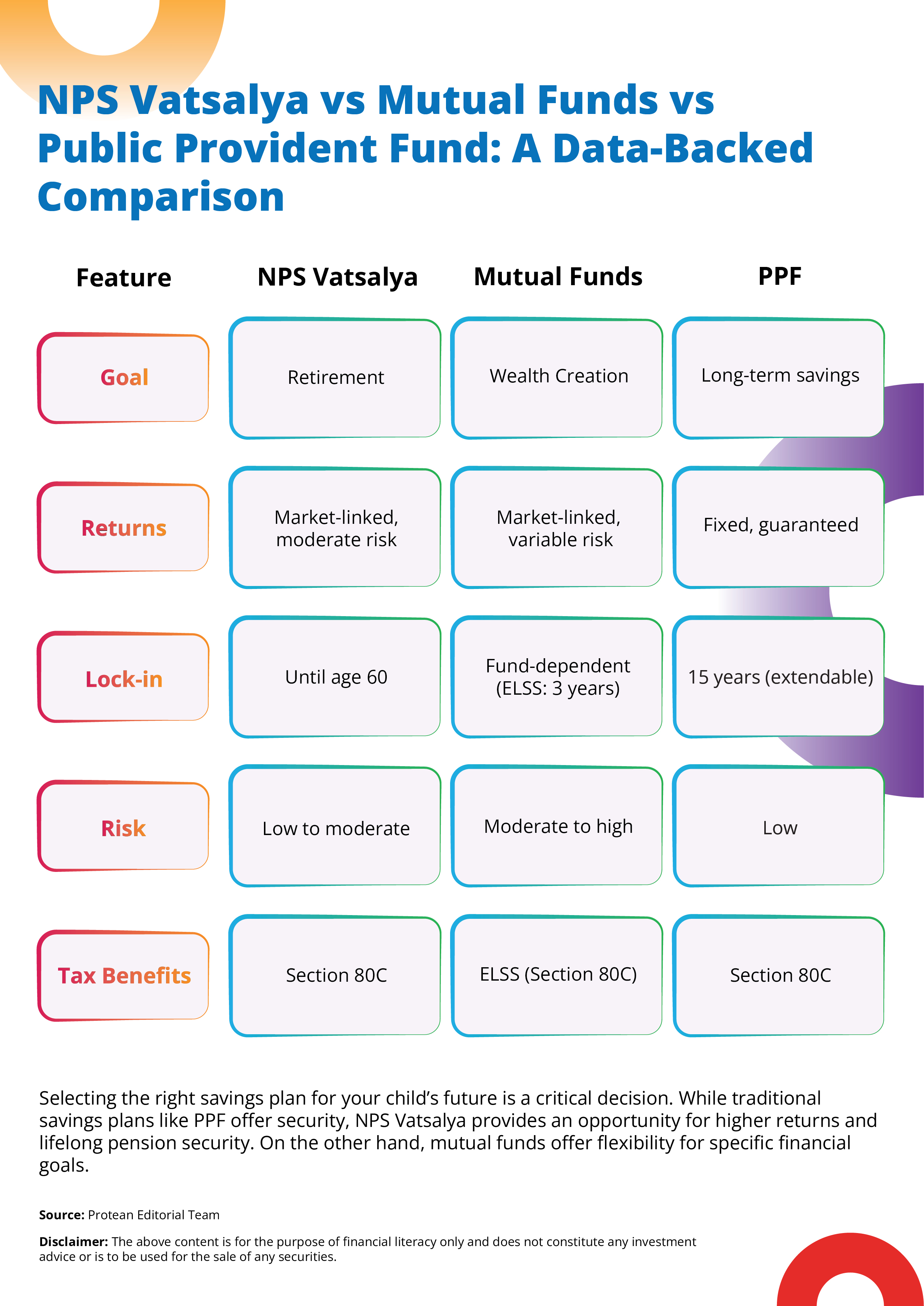

NPS Vatsalya vs Mutual Funds vs Public Provident Fund: A Data-Backed Comparison

Conclusion: Start Investing Today

The introduction of NPS Vatsalya provides a valuable new avenue for parents planning their children's financial future, specifically for retirement. While traditional options like Mutual Funds and PPF offer benefits like investment flexibility and guaranteed returns, respectively, NPS Vatsalya carves a niche by focusing on long-term pension security with the potential for higher market-linked returns. The choice between these depends on individual risk tolerance and financial goals. For guaranteed returns, PPF is suitable. For flexible goal-based investing, mutual funds are a good fit. But for building a retirement nest egg for a child, NPS Vatsalya appears to be a compelling option.

Start investing today to secure your child’s financial future. |

Frequently Asked Questions about NPS Vatsalya:

Opening of NPS Vatsalya Account

Accumulation under NPS Vatsalya Account

Partial or full exit from NPS Vatsalya Account

- Story by Bruhadeeswaran R.